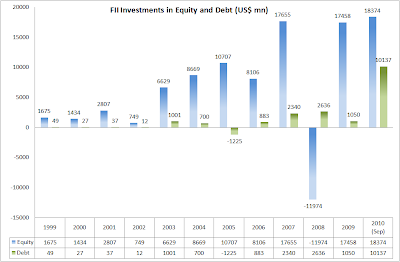

Foreign Institutional Investors are betting heavily on the India growth story. By the end of September, 2010, the FII investment in calendar year 2010 stood at US $ 28.5 bn, out of which US $ 18.4 bn were in equity while US $ 10.1 bn were in debt instruments.

|

| Figure 1: FII Investments in Equity and Debt (Source: SEBI) |

During 2010 the cumulative investments by FIIs in India, has already crossed the highest investments India has ever received in any calendar year. FIIs are the driving force in the market. During the month of September, Nifty has risen by 11.62%.

|

| Figure 2: Total FII Investments (Source: SEBI) |

At the current rate FIIs inflows are on track to exceed US$ 40bn by the end of 2010.

No comments:

Post a Comment