|

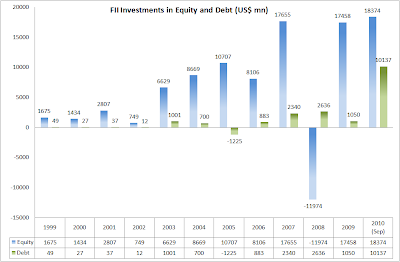

| Figure 1: FII Investments in Equity and Debt (Source: SEBI) |

|

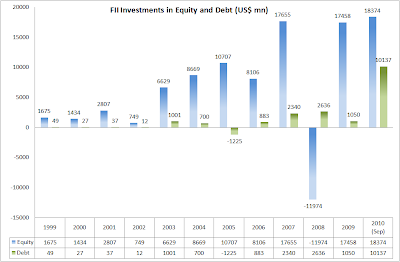

| Figure 2: Total FII Investments (Source: SEBI) |

At the current rate FIIs inflows are on track to exceed US$ 40bn by the end of 2010.

|

| Figure 1: FII Investments in Equity and Debt (Source: SEBI) |

|

| Figure 2: Total FII Investments (Source: SEBI) |

James Grant is the editor of Grant's Interest Rate Observer. Among his books is "The Trouble with Prosperity." He is often referred to as a “perma-bear.” Reporters ring him up when there is a downturn in the markets. A glass half empty kind of guy. His recent article in The Wall Street Journal and newly bullish stance has caused a buzz in the US markets.

The Market Does What It Wants To Do

Sharp rallies are the rule in a bear market, not the exception. It is common for the market to rocket upward in an overall downtrend. Take a look at the following chart of the Dow Jones from 1929 – 1932.

During that time, there were seven major declines and six major rallies. The rallies ranged from 19% to as high as 101%. And in every case, investors probably thought the worst was over and a new bull market had dawned.

This rally has not been built on the foundation of improving fundamentals. There is still too much wrong with the economy to hope that a new bull market is beginning just yet.

What To Do?

Don't sell and exit the market. This rally could run much higher regardless of the fundamentals. Book 50% of your profits, set trailing stop losses and let the rest of your profits ride.

India's phenomenal growth of the last five years was powered in large part by huge injections of cash and investment. Investment accounted for about 39% of the country's gross domestic product in the 2008 fiscal, up from 25% five years ago. At its peak, more than a third of investment came from abroad. At its peak, more than a third of investment came from abroad.

But in the last three months of last year, foreign loans and direct investment fell by nearly a third, to their lowest level in more than two years.

The decline in foreign investment has taken a big toll on sectors like real estate, manufacturing and infrastructure. In the last quarter of 2008, the economy's growth rate plummeted to about 5.3%, the lowest in five years.

For 8-9% growth rate, private investment and low cost of capital is essential. The Government's Fiscal Deficit has ballooned to 10% of GDP. The Government is expected to borrow Rs 300000 crore this year compared to Rs 120000 few years ago. Such large borrowings will crowd-out the private sector and lead to an increase in interest rates.

Cutting subsidies, reducing the fiscal deficit and attracting foreign investment should be top of the 'To Do' list for the Government.