|

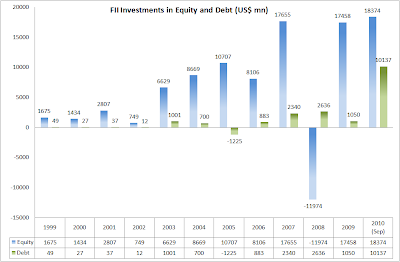

| Figure 1: FII Investments in Equity and Debt (Source: SEBI) |

|

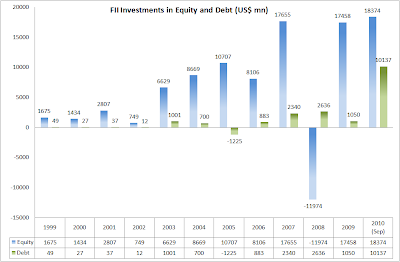

| Figure 2: Total FII Investments (Source: SEBI) |

At the current rate FIIs inflows are on track to exceed US$ 40bn by the end of 2010.

|

| Figure 1: FII Investments in Equity and Debt (Source: SEBI) |

|

| Figure 2: Total FII Investments (Source: SEBI) |

| ||||||

| Location of Massmart's stores in South Africa (Source: Company Website) |

|

| Location of Massmart's stores outside South Africa (Source: Company Website) |

|

| Rapid Growth in Earnings (Source: Author analysis, Company Data) |

India's phenomenal growth of the last five years was powered in large part by huge injections of cash and investment. Investment accounted for about 39% of the country's gross domestic product in the 2008 fiscal, up from 25% five years ago. At its peak, more than a third of investment came from abroad. At its peak, more than a third of investment came from abroad.

But in the last three months of last year, foreign loans and direct investment fell by nearly a third, to their lowest level in more than two years.

The decline in foreign investment has taken a big toll on sectors like real estate, manufacturing and infrastructure. In the last quarter of 2008, the economy's growth rate plummeted to about 5.3%, the lowest in five years.

For 8-9% growth rate, private investment and low cost of capital is essential. The Government's Fiscal Deficit has ballooned to 10% of GDP. The Government is expected to borrow Rs 300000 crore this year compared to Rs 120000 few years ago. Such large borrowings will crowd-out the private sector and lead to an increase in interest rates.

Cutting subsidies, reducing the fiscal deficit and attracting foreign investment should be top of the 'To Do' list for the Government.